8 - The Costs of Taxation#

8.1 - The Deadweight Loss of Taxation#

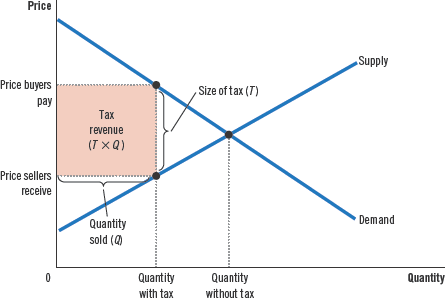

The amount that the government gains from a tax can be calculated with the size of the tax \(T\) and the quantity of the good sold \(Q\):

As such, the tax revenue is equal to the area of the tax wedge created by instituting the tax:

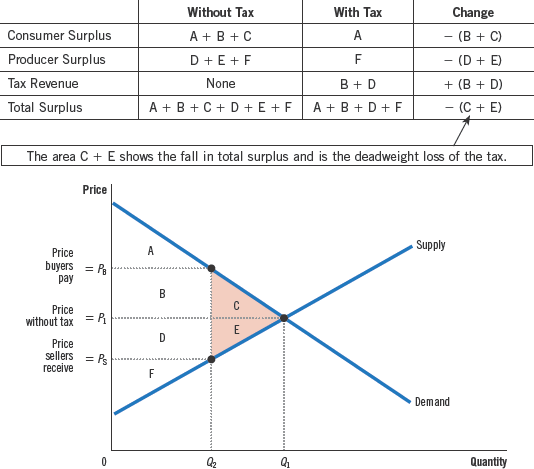

Taxes have the following effects on welfare:

When the tax is put in place, the price paid by buyers rises from \(P_1\) to \(P_B\) (so consumer surplus is only area \(A\)) and the price received by sellers falls from \(P_1\) to \(P_S\) (so producer surplus is only area \(F\)). The tax income is \(B + D\), so the total surplus is \(A + B + D + F\).

The losses to buyers and sellers from a tax exceed the revenue raised by the government. The fall in surplus that results when a tax distorts the outcome in an otherwise efficient market is called a deadweight loss. This area is represented by \(C + E\) in the example above.

Taxes cause deadweight losses because they prevent buyers and sellers from realizing some of the gains from trade.

8.2 - The Determinants of the Deadweight Loss#

The greater the elasticities of supply and demand, the larger the deadweight loss of a tax.

There exists debate on the elasticity of labor. Some economists argue that the supply of labor is inelastic, since they believe that most workers would work a full-time job regardless of the tax rate. Other economists point out that many aspects of the labor market respond to incentives:

Some people may adjust hour worked

Second earners in a household may choose to stay home or work part- or full-time based

Workers can choose to retire

Some people may evade taxes by working under the table in the underground economy

8.3 - Deadweight Loss and Tax Revenue as Taxes Vary#

The Laffer curve demonstrates that raising the tax rate may lead to a decline in total tax revenue since deadweight loss increases quadratically with respect to tax rates while tax revenue increases linearly.

The economic view of Reagan and Laffer that cutting the tax rate would encourage people to increase the quantity supplied of their labor and thereby increase the overall tax revenue is called supply-side economics.