10 - Externalities#

An externality is the uncompensated impact of a person’s actions on the well-being of a bystander. If the impact on the bystander is adverse, it is a negative externality. If it is beneficial, it is a positive externality.

10.1 - Externalities and Market Inefficiency#

Negative Externalities#

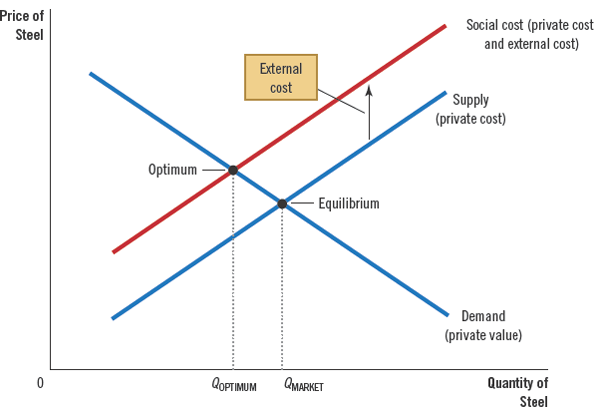

Social cost includes both the direct, private costs of producers and the costs to bystanders affected by negative externalities (such as pollution).

A committee of benevolent social planners would set the price where the social cost intersects the demand curve. To achieve this outcome, the government could impose a tax that shifts the supply curve upward such that it matches the social cost. Economists say that such a tax would internalize the externality.

Positive Externalities#

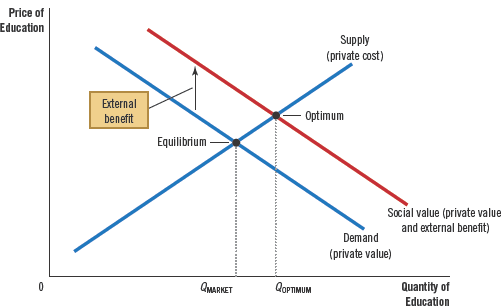

The social value of something with a positive externality (such as education) is not reflected in the private value of the good. Because of this, without outside education, the market would produce too little of the good.

In order to internalize the externality in this case, the government would provide a subsidy in order to achieve the optimal social value.

Another example of a positive externality is technology spillover, which measures the impact of one firm’s research and production efforts on those of other firms.

10.2 - Public Policies toward Externalities#

In general, the government can respond to externalities in one of two ways:

Command-and-control policies regulate behavior directly

Market-based policies provide incentives so that private decision makers choose to solve the problem on their own

Command-and-Control Policies: Regulation#

The government can remedy an externality by either requiring or forbidding certain behaviors.

This can be complicated because certain industries are incentivized to conceal the adverse health effects from their production.

Market-Based Policy 1: Corrective Taxes and Subsidies#

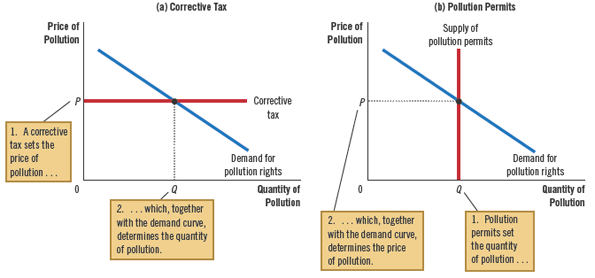

Taxes enacted to induce private decision makers to take into account the social costs that arise from a negative externality are called corrective taxes or Pigovian taxes.

In general, corrective taxes are preferred over regulation because they are more efficient and incentivize firms to develop more efficient methods of minimizing the social cost.

Market-Based Policy 2: Tradable Pollution Permits#

By allowing firms to trade the right to pollute a certain amount, this creates a market that optimizes the efficiency of the pollution that is done.

This method restricts the quantity of pollution, which differs from the corrective tax method, which restricts the costs of pollution.

10.3 - Private Solutions to Externalities#

The Coase Theorem#

The Coase theorem is the proposition that if private parties can bargain without cost over the allocation of resources, they can solve the problem of externalities on their own.

The Coase theorem says that private economic actors can potentially solve the problem of externalities among themselves. Whatever the initial disruption of rights, the interested parties can reach a bargain in which everyone is better off and the outcome is efficient.

Why Private Solutions Do Not Always Work#

Sometimes, the interested parties fail resolve an externality problem because of transaction costs, which are the costs that parties incur in the process of agreeing to and following through on a bargain. An example of this is legal fees.

Other times, bargaining can simply break down. This is especially the case when the number of interested parties is very large, since it is difficult to take the wants and needs of all parties into account.