15 - Firms in Competitive Markets#

A firm that influence the market price of the good it sells is said to have market power.

15.1 - What is a Competitive Market?#

The Meaning of Competition#

A competitive market, sometimes called a perfectly competitive market, has two (or sometimes three) characteristics:

The market has many buyers and many sellers.

The goods offered by the various sellers are largely the same.

(Sometimes) Firms can freely enter or exit the market.

Under these conditions, the actions of any single buyer or seller have a negligible impact on the market price.

Buyers and sellers in competitive markets must accept the price the market determines and are called price takers.

The Revenue of a Competitive Firm#

In a competitive market, the amount of a good produced has no effect on the price that it is sold, since all sellers must adhere to the market price. For all types of firms, the average revenue is equal to the price of the good.

For competitive firms, marginal revenue is equal to the price of the good.

15.2 - Profit Maximization and the Competitive Firm’s Supply Curve#

The Marginal-Cost Curve and the Firm’s Supply Decision#

Because the firm’s marginal-cost curve determines the quantity of the good the firm is willing to supply at any price, the marginal-cost curve is also the competitive firm’s supply curve.

The Firm’s Short-Run Decision to Shut Down#

A shutdown refers to short-run decision not to produce anything during a specific period because of current market conditions. Exit refers to a long-run decision to leave the market.

In the short-run, fixed costs are considered a sunk cost.

A firm makes the decision to shutdown if the revenue that it would earn from producing is less than its variable costs of production.

The competitive firm’s short-run supply curve is the portion of its marginal-cost curve that lies above the average-variable-cost curve.

Spilt Milk and Other Sunk Costs#

A sunk cost is a cost that has already been committed and cannot be recovered.

The Firm’s Long-Run Decision to Exit or Enter a Market#

A firm exits a market if the revenue it would get from producing is less than its total cost of production.

The entry rule is similarly

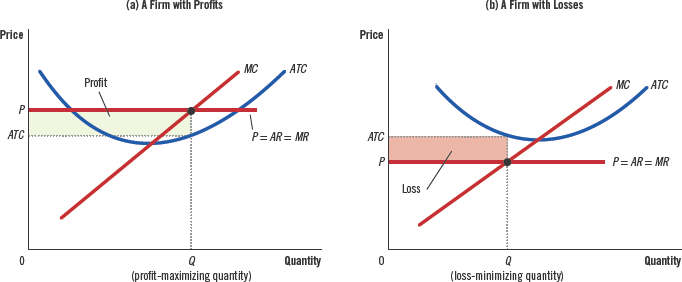

The competitive firm’s long-run supply curve is the portion of its marginal-cost curve that lies above the average-total-cost curve.

Measuring Profit in Our Graph for the Competitive Firm#

This can be used to calculate the firm’s profit when given the \(ATC\) and \(P\) on a price-supply curve.

15.3 - The Supply Curve in a Competitive Market#

The Short Run: Market Supply with a Fixed Number of Firms#

In the short run, market supply of firms is fixed.

The Long Run: Supply with Entry and Exit#

In the long run, firms enter and exit the market. As a result, at the end of the process firms and entering and exiting the market, the firms remaining in the market must be making zero economic profit. This is because the process of entry and exit ends only when price and average total cost are driven to equality.

In the long-run equilibrium of a competitive market with free entry and exit, firms operate at their efficient scale.

Why Do Competitive Firms Stay in Business If They Make Zero Profit?#

Competitive firms seek to make zero accounting profit, but they do make economic profit.

A Shift in Demand in the Short Run and Long Run#

When demand increases, price increases to account for the increased demand. In the long run, new firms join the market seeking profit, which in turn increases the quantity supplied, restoring equilibrium.

Why the Long-Run Supply Curve Might Slope Upward#

Because firms can enter and exit more easily in the long run than the short run, the long-run supply curve is typically more elastic than the short-run supply curve.